Account Statement: Financial Record Overview

Understanding the components of an account statement

Key elements and their significance

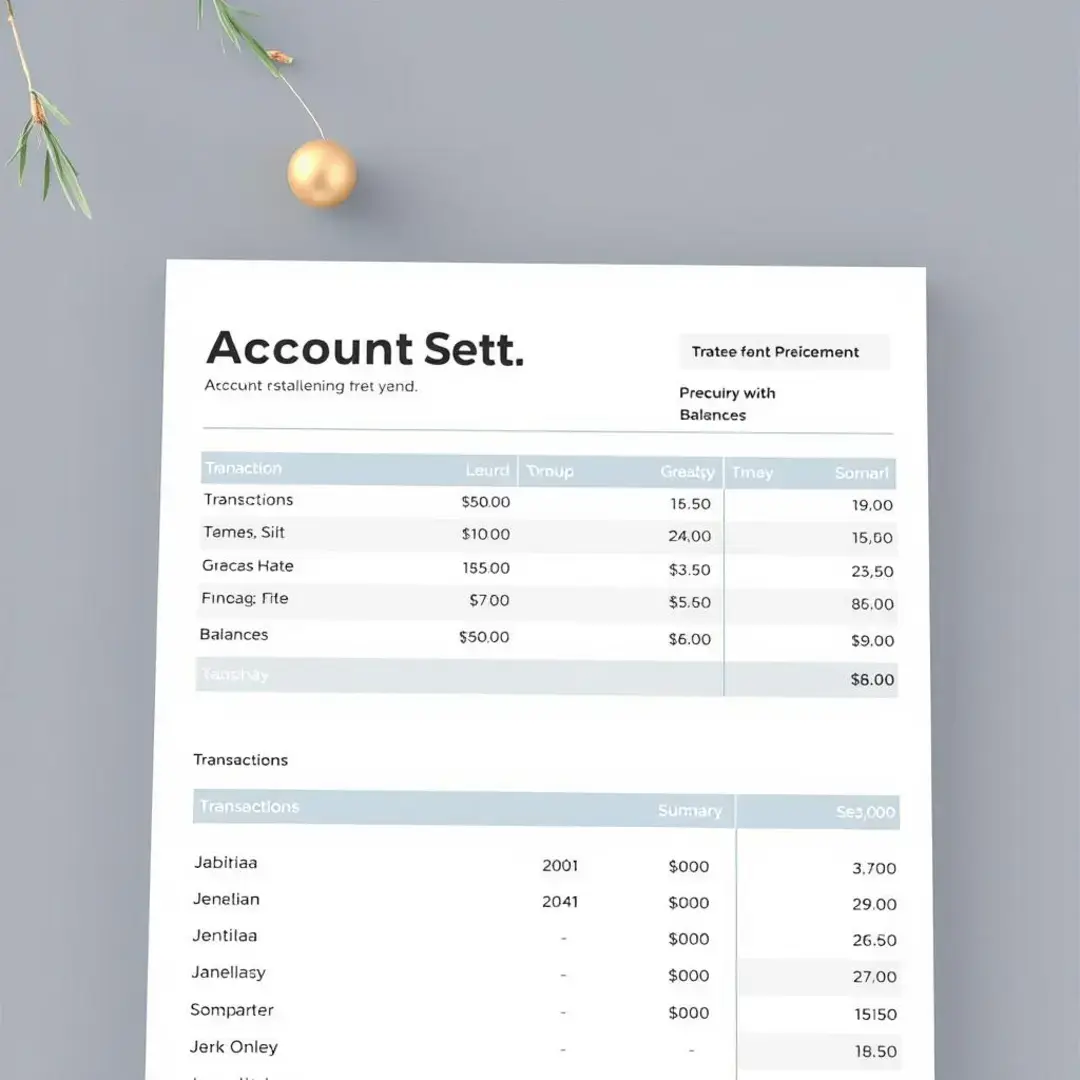

Transaction details are crucial for understanding your financial activity over a given period. They include deposits, withdrawals, and any transfers made to and from your account. Each line of transaction gives insight into spending habits and sources of income, which can be leveraged for better financial management. Being informed about these transactions helps in ensuring accuracy and identifying errors that may occur.

A balance summary provides a snapshot of your account’s health by showing the beginning balance, total credits, total debits, and the ending balance. This information is essential for assessing cash flow, financial stability, and for making future financial decisions. It enables you to quickly see whether you are on track with your financial goals or if you need to make adjustments. Keeping track of your balance summary can help prevent overdrafts and manage expenses effectively.

If your account earns interest, understanding how these calculations work is vital for maximizing your returns. Interest accrues based on the balance held, as well as the interest rate offered by the financial institution. Some accounts may offer compounded interest, which can significantly enhance your earnings over time. Monitoring interest calculations can motivate you to maintain higher balances and to choose accounts with better interest rates.

Many accounts have associated fees that can affect your overall financial picture. These can include monthly maintenance fees, transaction fees, and overdraft charges, among others. Being aware of these charges is essential because they can diminish your account balance unexpectedly. Regularly reviewing these fees will help you negotiate better terms with your bank or find accounts that suit your financial needs without unnecessary costs.

Interpreting different statement formats

With the advent of digital banking, electronic statements have become increasingly popular. They offer convenience, accessibility, and often come with tools for easier management of your finances. Many banks provide features that allow for quick searches, downloads, and the ability to analyze your transactions visually. However, it’s important to ensure the security of your digital statements to protect sensitive financial information.

Though electronic statements are gaining traction, paper statements still have their place, especially for those who prefer a tangible record. They can be easier to archive, read, or share, making them suitable for certain financial situations. Many consumers find that having a physical copy is helpful in instances where internet access is limited. Nevertheless, be cautious about how you store these statements due to the potential risk of identity theft.

Investment accounts require specific attention as they often encompass various financial instruments and transactions. An investment account statement provides details on securities, dividends, interest earned, and overall portfolio performance. Understanding this information is crucial for making informed investment decisions. Moreover, it is essential to review investment statements periodically to ensure that they align with your financial objectives.

Advanced analysis of account statements

Using statements for financial planning

Account statements serve as a foundational tool for tracking your income and expenses effectively. By closely analyzing these documents, you can develop a clear picture of where your money is coming from and where it is going. This insight is invaluable for budgeting and can aid in making informed decisions. Utilizing app-based budgeting tools that sync with your statements can enhance your ability to track financial movements.

Recognizing spending patterns from your account statements can help you identify habits that may require adjustment. For example, you might discover that a significant portion of your income is directed towards non-essential purchases. By having this awareness, you can set financial goals that encourage healthier spending habits and savings strategies. Making small changes can lead to substantial long-term benefits, including improved financial health.

By analyzing past and present account statements, you can project future balances based on your expected income and spending behaviors. This forward-thinking approach helps with planning large expenses and crucial financial commitments, supporting strategic decision-making. Having clear projections can enhance your financial confidence and readiness for upcoming expenses. Investments in tools that allow for forecasting based on historic data can significantly streamline this process.

Reconciling statements with personal records

Reconciling your account statements with personal records is crucial for ensuring accuracy in your financial tracking. This process typically involves checking entries against your records to identify any discrepancies. By setting aside time each month to reconcile, you’ll have a clear understanding of your financial situation. Emphasizing this practice makes it easier to stay organized and proactive about managing your finances.

Discrepancies between account statements and personal records can arise due to various factors, such as double entries or bank errors. It’s essential to address these issues promptly by contacting your financial institution or reviewing your records thoroughly. Aim to identify the root cause of these discrepancies and rectify them to ensure accuracy moving forward. Maintaining organized records can significantly reduce the frequency of these issues.

Leveraging statements for tax purposes

Account statements can be an invaluable resource when preparing for tax season, particularly for identifying deductible expenses. By sorting through your transactions, you can pinpoint expenses that qualify for tax deductions, such as business-related purchases or charitable donations. This preparation can lead to substantial tax savings and a more streamlined filing process. Consulting with a financial advisor might also be beneficial to maximize your deductions.

For those with investment portfolios, account statements provide essential information needed to calculate investment income accurately. This includes dividends received, capital gains, and accrued interest, all of which play a part in your tax liabilities. Keeping detailed records of these transactions enhances your ability to file taxes and can lead to better financial outcomes. Make it a practice to review this information regularly to maximize awareness of your overall financial situation.

Beyond the basics: maximizing the value of your statement

Analyzing trends and anomalies

Regularly reviewing account statements allows you to spot unusual activity that may indicate fraud or errors. By being vigilant about transactions, you can quickly address any unauthorized charges or incorrect entries. Taking immediate action helps protect your financial assets and ensures your accounts are in good standing. Consider enrolling in monitoring services that notify you of significant changes or activities on your accounts for added security.

Account statements also serve as a tool for assessing potential financial risks. Trends such as consistent overdraft fees or increasing balances may hint at underlying financial issues. Identifying these patterns allows for timely interventions to mitigate risks and enhance overall financial wellness. Regularly addressing such concerns fosters a proactive approach to your personal finance management.

Utilizing statement data for investment decisions

Investment account statements offer valuable insights into your portfolio’s performance. By analyzing these statements, you can evaluate which investments are yielding returns and which are underperforming. This information can inform decisions about reallocating resources or adjusting your investment strategy. A well-rounded approach to portfolio assessment fosters robust investment decisions that align with long-term financial goals.

Investors can leverage the data found in account statements to evaluate the effectiveness of their investment strategies. By comparing gains and losses to market averages and benchmarks, you can discern whether your strategy is yielding desired outcomes. Re-evaluating your approach based on this analysis ensures that you adjust your strategy to enhance returns. Keeping your finger on the pulse of your investments leads to informed decision-making and financial growth.

Integrating statement information with financial software

Incorporating account statement data into financial software can greatly enhance your management efficiency. Many modern tools allow for automated data entry, significantly reducing the workload associated with manual input. automation can also provide real-time insights into your finances, promoting timely decision-making. This upgraded process enriches your financial oversight and makes managing your accounts a smoother experience.

With the integration of statement data into financial software, generating customized reports becomes a powerful tool for analysis. These reports can help you focus on particular financial metrics and trends that matter most to you. By tailoring reports to your needs, you can uncover deeper insights into spending habits, investment performance, and overall financial health. The ability to visualize this data enhances understanding and promotes better financial decisions moving forward.