Tax information digest: Summarize significant tax law adjustments

Keep track of estimated tax payments and changes in tax laws with tax information digest. Simplify your finance tasks and stay informed!

Similar apps

Streamline your tax information processing

Effortless summarization of tax law changes

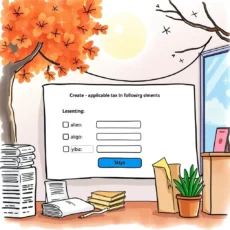

Intuitive form fields for comprehensive input

The Tax Information Digest features multiple user-friendly form fields, allowing you to enter essential details such as your name, job title, and estimated tax payment amount. This structured input helps ensure high-quality, accurate summaries that capture every significant aspect of tax law changes without missing vital information.

User-centric output with tailored summaries

Once you provide the necessary inputs, our web app processes them through a sophisticated LLM to generate precise summaries of significant tax law adjustments. Tailor-made for professionals in finance and accounting, these outputs save time and enhance compliance by providing clear insights into the latest tax regulations.

Seamless integration of relevant notes

The app allows users to add important notes or comments regarding tax payments directly into the input form. This feature empowers you to include personalized insights or reminders related to specific cases and ensures that every summary reflects your unique context and decision-making needs.

Timely updates from reliable sources

Easily enter the date of the last tax law update and the source of the information, ensuring that your summaries reflect the most current regulations. By tracking these updates systematically, users stay informed on relevant legal changes that could impact their estimated tax payments.

Targeted for professional use in finance & accounting

Designed specifically for Tax Compliance Officers, Tax Analysts, Tax Managers, Financial Analysts, and Tax Reporting Specialists, this app delivers a focused solution for professionals who demand accuracy in their reporting and compliance efforts.

Additional information

Best for: Tax Compliance Analyst, Tax Research Specialist, Tax Manager, Tax Policy Advisor, Tax Strategist