Tax compliance tracker: Simplified updates on tax compliance changes

Stay on top of your estimated tax payments with tax compliance tracker. Monitor tax law changes, set due dates, and keep organized notes.

Similar apps

Streamline your tax compliance process effortlessly

Stay informed on key tax changes

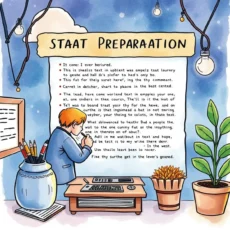

Text input for comprehensive data collection

Easily input essential information including your name, job title, tax year, estimated payment amounts, and due dates. This feature ensures that all relevant tax compliance data is centrally captured for easy access and review.

Customizable notes for enhanced clarity

Add personal insights by including notes or comments surrounding each payment. This function allows users to contextualize the data entries effectively and provides clarity on specific details about tax law changes or payment circumstances.

Source tracking for reliable information

Keep track of the origins of tax law information submissions. Users can enter sources related to tax law changes to ensure that all data is backed by credible references, fostering transparency and accountability in financial reporting.

Last review date input for up-to-date compliance

Log the last review date of relevant tax laws to remain informed on compliance requirements. By maintaining a record of when regulations were last checked, users can better manage their tax obligations and ensure timely updates are integrated into their workflows.

Departmental identification for collaborative workflows

Specify your department or team name to facilitate collaboration within finance and accounting teams. This feature enables streamlined communication and coordination among team members involved in managing estimated tax payments, ensuring everyone stays aligned with current responsibilities.

Additional information

Best for: Tax Compliance Analyst, Tax Policy Specialist, Senior Tax Analyst, Tax Strategist