Audit documentation analyzer: Analyze and summarize documentation relevance for audits

The audit documentation analyzer helps finance and accounting teams collect, organize, and review essential audit documents seamlessly.

Similar apps

Streamline your audit planning with comprehensive documentation analysis

Transform complex documents into actionable insights for your audit process

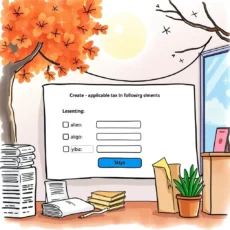

Efficient data input for streamlined analysis

Easily enter all relevant information about the document, from its name and date to the author and purpose. This ensures that nothing is overlooked when analyzing documentation, leading to more effective audits and accurate summaries tailored to your specific needs.

Enhanced relevance evaluation for accurate audit planning

Our tool assesses the relevance of documentation in relation to compliance requirements and previous audits. By synthesizing this data, users receive precise feedback that highlights critical insights essential for successful audit planning, helping teams stay organized and focused on priorities.

Robust notes section for comprehensive review

Utilize the dedicated notes section to track observations from prior audits related to each document. This feature allows auditors and analysts to build a thorough context around documentation, facilitating informed decisions throughout the audit lifecycle.

User-friendly input fields for maximum efficiency

The structured input fields prompt users to provide all necessary details seamlessly. By guiding you through entering specific compliance requirements, relevant timeframes, and additional comments, this straightforward approach guarantees accurate AI processing while maximizing efficiency during busy audit periods.

Additional information

Best for: Audit Analyst, Compliance Auditor, Internal Auditor, Audit Documentation Specialist, Financial Auditor