Asset write-off assistant: Manage asset write-offs and depreciation entries securely

The asset write-off assistant simplifies fixed asset management, allowing you to calculate depreciation and manage assets effectively with ease.

Similar apps

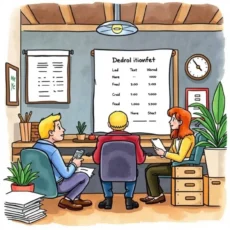

Streamlined asset management for finance professionals

Effortlessly manage depreciation entries and write-offs

Comprehensive data input for accurate asset analysis

Our web app provides a user-friendly interface to input essential asset details, including names, acquisition dates, purchase prices, useful life spans, and salvage values. This comprehensive data entry ensures the AI processes accurate depictions of your assets for all write-off and depreciation needs.

Flexible categorization of assets

Easily categorize your assets by selecting from various types such as machinery or vehicles. This tailored categorization allows for improved clarity in asset management and helps ensure that users receive more relevant insights based on the specific asset category they are working with.

Adaptable depreciation methods to suit your needs

Dive into different depreciation methods like straight-line or declining balance that best reflect the value reduction of your assets over time. Customizing your approach empowers Tax Managers and Fixed Asset Accountants to comply better with accounting standards while optimizing financial strategies.

Integrated current date insights for timeliness

Users can conveniently input the current date to track and manage asset depreciation effectively. Having this temporal reference complements the overall accuracy of calculations related to tax implications, providing Financial Controllers and Depreciation Analysts with timely financial insights.

Space for additional notes enhancing contextual understanding

Our application offers a dedicated space for users to add notes or comments about their assets, ensuring enhanced contextual understanding for each entry. This feature empowers Tax Compliance Specialists to pinpoint unique considerations quickly while aiding collaboration among team members.

Additional information

Best for: Tax Manager, Fixed Asset Accountant, Depreciation Specialist, Asset Management Consultant